nj property tax relief homestead benefit

Read about Senior Freeze Property Tax Reimbursement. That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits.

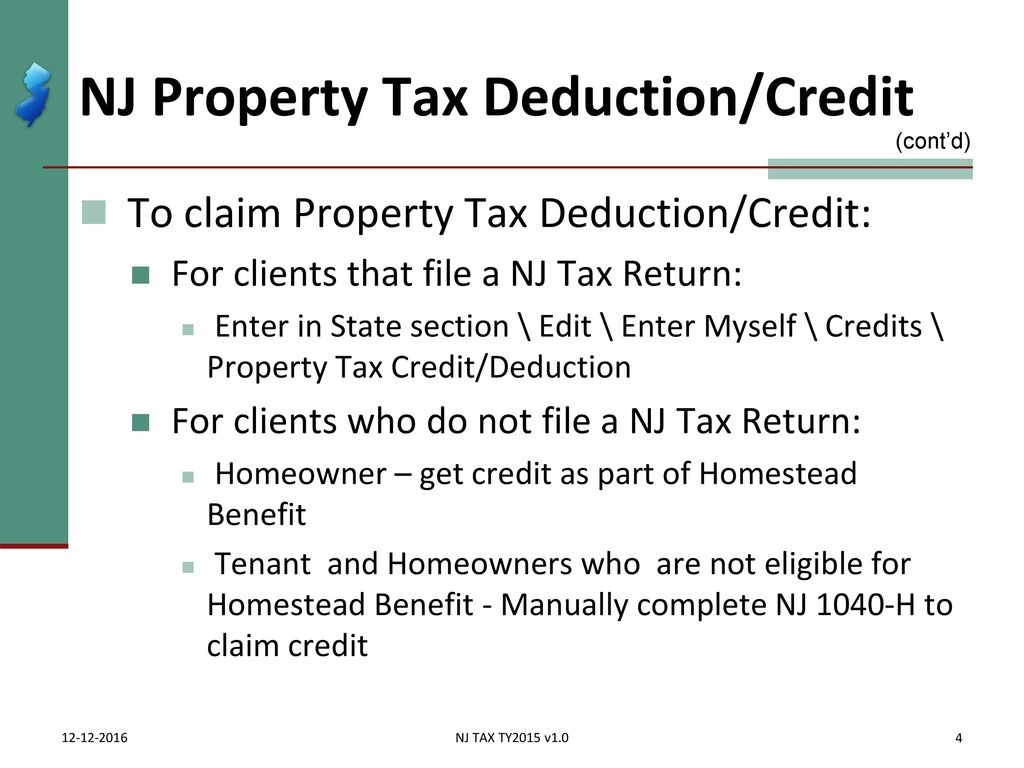

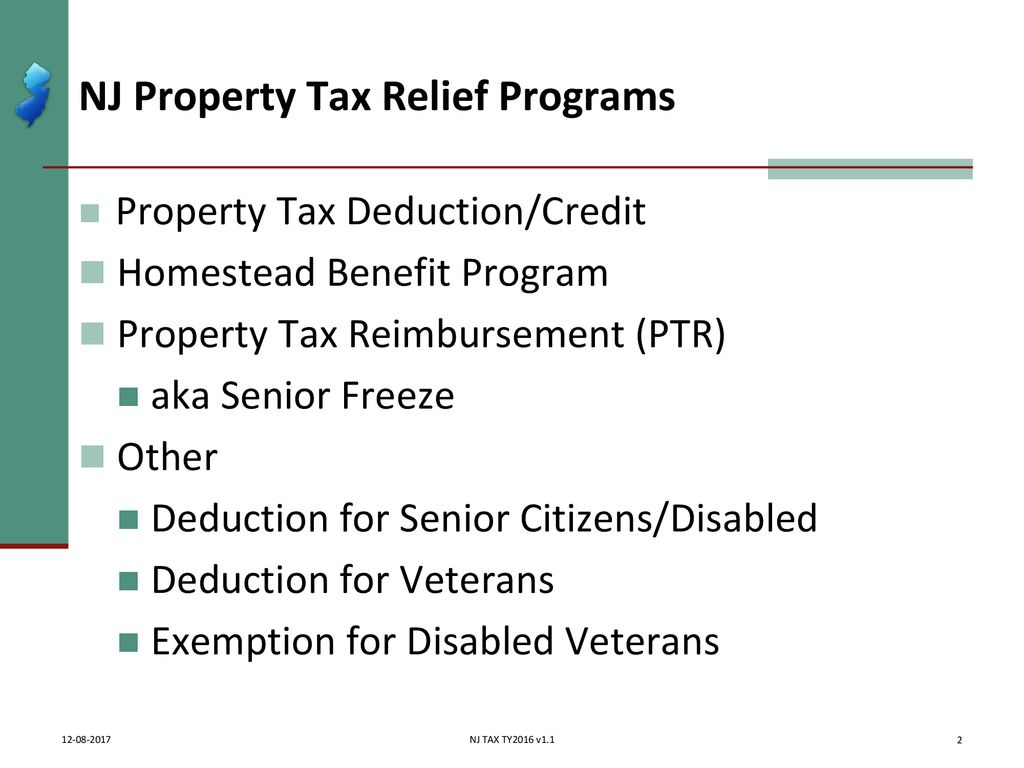

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

. Any approved benefit would be credited to your municipality and applied to your balance. If you were not a homeowner on October 1 2018 you are not eligible for a Homestead Benefit even if you owned a home for part of the year. See Homestead Benefit Program for more information or you can call 1-888-238-1233 Monday through Friday except State holidays.

Funding for the property tax relief program. 150000 or less for homeowners age 65 or over or blind or disabled. The current Homestead program funds direct benefits that total closer to 630 with those benefits only provided to senior and disabled homeowners earning up 150000 annually and all other homeowners earning up to.

Shortchanging recipients of Homestead tax relief. Thousands of New Jersey homeowners have begun receiving applications from the state Department of. New Jersey just increased funding for a key state property-tax relief program and this month homeowners across the state are getting their first opportunity to apply for those beefed-up tax breaks.

Under Murphys plan homeowners making up to 250000 annually would qualify for direct property-tax relief benefits averaging roughly 680. Governor Christie Expands Access to Property Tax Relief by Extending Homestead Benefit Filing Deadline. The Homestead Benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid.

Murphy plans to continue time-honored NJ tradition. The additions to the existing Homestead Benefit Act focus on low-income disabled and senior homeowners in the state. Certain seniordisabled homeowners who were not required to file a 2018 New Jersey Income Tax return will have their Property Tax Credit included with the Homestead Benefit.

In June New Jersey lawmakers revealed a new budget that will expand property tax relief for residents. Under Age 65 and not Disabled Homeowners. The current homestead benefit by tripling the number of residents.

New Jersey homeowners will not receive Homestead property tax credits on their Nov. If you are delinquent in paying your property taxes you are still eligible to file an application. Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by.

Property Tax Relief Programs. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000.

This means that if you indicated you still own the home when filing your application and later sell it the only way to receive your 2018 Homestead Benefit is to take credit for the benefit at the closing of your property sale. My 2018 property taxes are late. 1-877-658-2972 When you complete your application you will receive a confirmation number.

Review the updates to learn whether you may benefit from New Jersey property tax reform measures. You met the 2018 income requirements. Under a new property tax relief program unveiled Thursday homeowners and renters could be getting rebates every year.

Lawmakers from both sides of the aisle are making a case for halting the states long. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability.

Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if theyre under 65 and not blind or disabled. If you filed a 2017 Homestead Benefit application and you are. Read about the Homestead Tax Benefit Program.

Property taxes have ballooned 40 since then but Homestead benefits havent budged. Read about Deductions Exemptions and Abatements which includes information for Veterans and Active Military Members. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits.

If you did not receive a 2018 Homestead Benefit mailer and you owned a home in New Jersey on October 1 2018 that was your main home call the number above for help. Visit the New Jersey Department of Treasury for information on property tax relief programs. 75000 or less for homeowners under age 65 and not blind or disabled.

File Online or by Phone. We can deduct any amount you owe from future Homestead Benefits or Income Tax refunds or credits before we issue the payment. Can I still file for a Homestead Benefit.

Nows the time to apply for bigger Homestead relief benefits. Homestead benefits have been frozen in time as state uses property-tax bills from 2006. 1 real estate tax bills a state treasury official said Wednesday.

October 9 2012 Andy Pratt or Bill Quinn 609 633-6565. 4 rows Amounts you receive under the Homestead Benefit Program are in addition to the States other. Trenton Acting to ensure that as many New Jerseyans as possible receive property tax relief Governor Chris Christie has extended the deadline for filing Homestead Benefit applications to Friday December 14.

Halloween Snowstorm Extends Application Deadlines For N J Homestead Benefits And Senior Freeze Tax Rebate Program Nj Com

Senior Freeze Homestead Benefit Programs River Vale Nj

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Memoli Company Pc Home Facebook

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Can I File An Appeal For The Homestead Rebate Nj Com

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

The Different Types Of Candles And Their Benefits And Specialities Honey Candle Beeswax Candles Candle Making

Nj Property Tax Relief Program Updates Access Wealth

Quit Claim Deed Pdf Quites Quitclaim Deed Words

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating